Imagine this: for the same cost as shipping a single pallet of high-end smartphones by air, you could ship an entire 20-foot container filled with thousands of t-shirts by sea. This isn’t just a casual comparison; it’s a stark illustration of the monumental cost difference that shapes global trade. For any importer, understanding this disparity is fundamental. But the critical question isn’t just if sea freight is cheaper, but why sea freight is cheaper than air freight and how you can leverage this knowledge to build a smarter, more profitable supply chain.

The answer isn’t a simple one-liner. It’s a complex interplay of physics, economics, and colossal engineering. This comprehensive guide will not merely list the reasons; it will deconstruct them. We will journey into the world of massive container ships and sleek cargo planes, exploring the core principles that dictate their costs. We’ll dive deep into:

The incredible power of scale that allows ocean liners to move goods for pennies on the dollar.

The fundamental physics and economics of fuel and operations that give maritime transport an unbeatable edge.

The strategic situations where the premium price of speed for air freight becomes a necessary and wise investment.

The hidden costs and crucial trade terminologies (Incoterms) that every importer must master.

This is more than an explanation; it’s a strategic guide. By the end, you won’t just know why sea freight is cheaper—you’ll have a robust framework to decide when to use it, when to opt for air, and how to make the most cost-effective and strategic decisions for your business.

The single most significant reason behind the affordability of sea freight can be summarized in two words: economies of scale. The sheer size and carrying capacity of modern container vessels create a cost efficiency that air freight, by its very nature, can never hope to match. This isn’t just a minor advantage; it’s a paradigm-defining difference that underpins the entire structure of global merchandise trade.

To truly grasp this, let’s visualize the scale. A standard cargo aircraft, like a Boeing 747-8F, is a marvel of engineering, capable of carrying approximately 140 metric tons of cargo. This is an impressive feat.

Now, consider a large modern container ship, such as those in the Evergreen A-class. These behemoths of the sea are over 1,300 feet long—longer than four football fields laid end to end. Their capacity is not measured in tons but in TEUs (Twenty-foot Equivalent Units). A single vessel of this class can carry nearly 24,000 TEUs. A standard 20-foot container can hold around 25,000 t-shirts. Doing the math, that’s a staggering 600 million t-shirts on one ship.

To move that same amount of cargo by air, you would need a fleet of over 1,500 Boeing 747-8F cargo planes. This simple comparison illuminates the foundational difference: a single ship, with a single crew and a single engine (albeit a massive one), does the work of thousands of aircraft.

This immense scale has a profound impact on the unit cost of shipping. Every cost associated with a sea voyage—from the crew’s salaries and the fuel consumed to port fees and vessel maintenance—is divided among the tens of thousands of containers on board. When you ship one container, you are essentially renting a tiny fraction of an enormous floating warehouse. The cost allocated to your single container becomes remarkably small.

This principle is the bedrock of the sea freight vs air freight cost debate. While an airplane might move goods from Shanghai to Los Angeles in under a day, it does so in small, expensive batches. A container ship takes three to four weeks for the same journey, but it moves a city’s worth of goods in one go. The cost of fuel, labor, and capital is spread so thinly across this vast volume that the per-item cost becomes almost negligible.

This economic reality is precisely why the vast majority of consumer goods, raw materials, and manufactured products travel by sea. From the furniture in your home to the car in your driveway, it’s almost certain they spent time on a container ship.

For an importer, understanding and leveraging this scale is key to profitability. The larger the volume of goods you can ship at once, the more you can benefit from these economies of scale. This is where strategic sourcing and procurement come into play. By planning your inventory needs and consolidating orders, you can maximize the use of full container loads (FCL), driving your per-unit shipping cost even lower. Exploring strategies for consolidating orders is a crucial step, and you can learn more about how to buy in bulk from China to optimize this process. By doing so, you are not just buying goods; you are buying into the powerful economic engine of maritime logistics.

While economies of scale provide the most dramatic explanation for sea freight’s cost advantage, the underlying physics of movement and the corresponding operational economics play an equally crucial role. Moving an object through water is fundamentally more energy-efficient than lifting it and propelling it through the air, and this scientific reality has massive financial consequences.

The core difference lies in a single, powerful force: gravity.

Air Freight: An aircraft must generate an immense amount of lift to overcome gravity and keep itself and its cargo airborne. This requires incredibly powerful engines running at high thrust for the entire duration of the flight. It is in a constant, energy-intensive battle against the pull of the earth. The fuel consumption is colossal, not just to move forward, but to simply stay in the air.

Sea Freight: A ship, by contrast, leverages the principle of buoyancy. It floats. The primary force it needs to overcome is not gravity, but the friction of water (drag) and wind resistance. While moving a 200,000-ton vessel through water requires a powerful engine, the energy needed per ton of cargo is vastly lower because the water is already supporting the vessel’s weight.

To put it in perspective, studies have shown that maritime shipping is, on average, four to six times more fuel-efficient than air freight when measured by the ton-mile (the energy used to move one ton of cargo one mile). This efficiency gap is the single largest factor in the operational cost difference. Fuel is a major expense for any logistics operation, and since airplanes burn significantly more of it per unit of cargo, their operating costs are inherently higher.

Beyond fuel, the day-to-day costs of running these two types of transport services diverge significantly.

Labor Costs: Consider the human element. A massive container ship carrying 20,000 TEUs can be operated by a crew of just 20 to 25 people. In contrast, to move the same volume of cargo by air would require over 1,500 flights, involving thousands of pilots, co-pilots, and an army of ground crew for loading, unloading, and refueling each aircraft at multiple airports. When you compare the labor cost per container, sea freight’s efficiency is again overwhelming.

Infrastructure and Maintenance: The infrastructure that supports these industries also comes with vastly different price tags.

- Airports vs. Seaports: Airports are incredibly complex and expensive to build and maintain. They require long runways, sophisticated air traffic control systems, massive passenger terminals (even for cargo-focused airports), and extensive security infrastructure. Seaports are also monumental investments, but their infrastructure—docks, cranes, and storage yards—is designed for durability and handling immense volume over longer periods. The sheer throughput of a major seaport like Shanghai or Rotterdam means the cost of this infrastructure is spread over a much larger volume of cargo than at even the busiest air cargo hub.

- Vessel vs. Aircraft Maintenance: Aircraft maintenance is notoriously expensive and stringent. Every component has a strictly enforced service life, and the technical complexity of jet engines and avionics requires highly specialized and costly labor. A commercial aircraft undergoes constant checks and major overhauls. While ships also require regular maintenance and dry-docking, their mechanical systems are generally less complex, and the maintenance schedules are less frequent compared to the number of journeys undertaken.

In every aspect of operations—from the fuel burned per mile to the number of staff required per container—sea freight demonstrates a leaner, more efficient cost structure. This isn’t to say it’s a “better” mode of transport, but it is an inherently more economical one for moving large quantities of goods across the globe.

If sea freight is the undisputed champion of cost-efficiency, air freight is the king of speed. The higher price tag of air freight vs sea freight is not an arbitrary markup; it is a premium paid for the single most valuable commodity in modern business: time. Understanding when this premium is a worthwhile investment is crucial for any importer looking to optimize their supply chain.

The choice is rarely just about the direct shipping cost. It’s a strategic calculation where the transit time can have a greater impact on the bottom line than the freight bill itself. A container ship might take 3-5 weeks to cross the Pacific, while a cargo plane makes the journey in less than 24 hours. This staggering difference in speed creates value in several key scenarios.

Choosing air freight is a strategic decision often dictated by the nature of the product, market demand, or a specific business need. Here are the primary situations where the high cost is justified:

High-Value, Low-Volume Goods: For products like consumer electronics, luxury watches, or critical microchips, the shipping cost represents a very small percentage of the product’s total value. The financial risk of having millions of dollars of high-value inventory tied up for a month at sea is far greater than the cost of flying it to its destination in a day. Furthermore, the shorter transit time reduces the risk of theft, damage, and exposure to the elements. When sourcing valuable products, understanding the logistics is as important as the product itself, which is a key consideration in learning how to import electronics from China.

Perishable Goods: This is the most obvious use case for air freight. For products with a short shelf life—such as fresh flowers from Kenya, high-end seafood from Japan, or exotic fruits from South America—sea freight is not an option. The value of these goods would diminish to zero long before a ship could reach its destination. Air transport allows these items to be on store shelves across the world while they are still fresh, commanding a premium price that more than covers the shipping cost.

Time-Sensitive Fashion and Seasonal Products: The “fast fashion” industry is built on speed. Trends can emerge and fade in a matter of weeks. For these companies, the ability to quickly move a new clothing line from a factory in Asia to stores in Europe or North America is a massive competitive advantage. Waiting a month for sea freight would mean missing the trend entirely. The cost of air freight is simply factored into the price of the product, a necessary expense to ensure the goods arrive at the peak of their demand.

Urgent Samples, Prototypes, and Spare Parts: In the world of manufacturing and product development, speed is critical. A potential client might need a product sample to sign a multi-million dollar deal. A factory production line might be shut down, losing thousands of dollars an hour, waiting for a single critical spare part. In these scenarios, the cost of air freight is insignificant compared to the cost of delay. It’s an emergency service that keeps business moving.

Ultimately, the decision to use air freight is an investment in agility, security, and speed. It allows businesses to respond quickly to market changes, minimize inventory holding costs for high-value items, and avert costly delays. While sea freight moves the bulk of the world’s goods, air freight moves its most urgent and valuable ones.

One of the most common pitfalls for novice importers is focusing solely on the quoted freight rate. The initial sea freight rates or air freight charges you receive are often just the base cost of transportation. The final bill will invariably include a list of surcharges and fees that can significantly increase the total cost. Understanding this “all-in” cost is essential for accurate budgeting and maintaining your profit margins.

Furthermore, the responsibility for these costs is defined by a set of universal trade rules known as Incoterms. Mastering these terms is not optional; it’s a fundamental requirement for anyone involved in international trade.

Both sea and air freight have their own specific sets of additional charges, which are levied to cover variable costs or specific services.

Common Sea Freight Surcharges:

THC (Terminal Handling Charge): This covers the cost of handling the container at the port of origin and destination, including loading, unloading, and storage. It is charged by the port authority and passed on to the shipper.

BAF (Bunker Adjustment Factor) or FAF (Fuel Adjustment Factor): This is a variable surcharge that adjusts for fluctuations in global oil prices. As fuel is a major component of the voyage cost, carriers use the BAF to manage the risk of price volatility.

CAF (Currency Adjustment Factor): This charge is applied to compensate for exchange rate fluctuations between the currency of the freight charge and the carrier’s operating currency.

ISPS (International Ship and Port Facility Security) Fee: A charge to cover the costs of implementing the mandatory security measures required by the ISPS code post-9/11.

Documentation Fee: Carriers charge a fee for preparing and processing essential shipping documents like the Bill of Lading.

Common Air Freight Surcharges:

Fuel Surcharge (FSC): The air freight equivalent of BAF. Given the high fuel consumption of aircraft, this is often a very significant component of the total cost.

Security Surcharge (SSC): Covers the cost of screening and securing cargo before it’s loaded onto the aircraft.

Terminal/Handling Fee: Similar to sea freight’s THC, this covers the handling of goods at the airport’s cargo terminal.

Airway Bill (AWB) Fee: A fee for the issuance of the Airway Bill, the key contract of carriage in air transport.

These are just a few examples. The list can be long and includes fees for customs clearance, port congestion, or handling hazardous materials. A good freight forwarder or sourcing agent will provide a detailed quote that breaks down all anticipated charges.

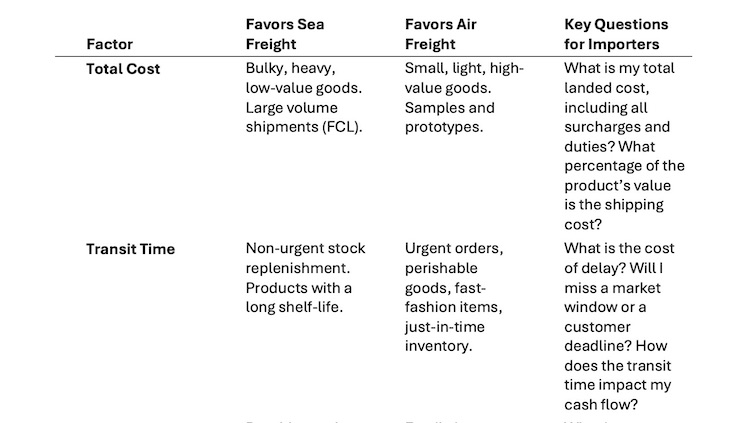

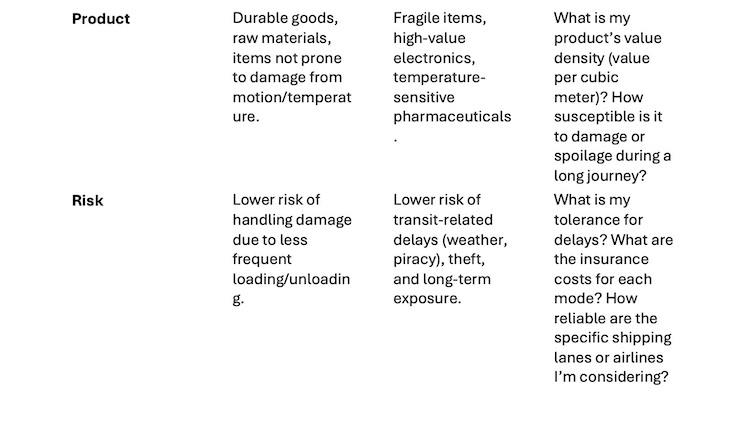

The choice between sea and air freight is not a simple cost-per-kilo calculation; it’s a complex strategic decision with far-reaching implications for your entire business operation. It impacts your cash flow, inventory management, risk exposure, and ultimately, your relationship with your customers. To navigate this dilemma effectively, an importer must move beyond a tactical comparison and adopt a holistic, strategic framework.

This framework should be built on four pillars: Cost, Time, Product Characteristics, and Risk.

Your choice of freight mode has a direct and significant impact on your financial health and operational agility.

Cash Flow: This is one of the most critical, yet often overlooked, factors. When you choose sea freight, your goods will be in transit for several weeks. Typically, you will have paid your supplier for at least a portion (if not all) of the order value before it even ships. This means a significant amount of your capital is tied up in inventory that is inaccessible and generating no revenue. Air freight, with its rapid transit time, dramatically shortens this cash conversion cycle, freeing up capital that can be used for marketing, product development, or other growth activities.

Inventory Management: Sea freight necessitates a “just-in-case” inventory model. You must hold more safety stock to buffer against the long lead times and potential delays, which increases warehousing and insurance costs. Air freight facilitates a “just-in-time” (JIT) model, allowing you to carry leaner inventory, reduce storage costs, and be more responsive to changes in customer demand.

Making these complex trade-offs can be daunting, especially when dealing with overseas suppliers, multiple freight forwarders, and complex customs procedures. This is where the value of a professional partner becomes apparent. A skilled sourcing agent or supply chain consultant does more than just find products; they provide critical strategic guidance.

They can help you:

* Negotiate favorable Incoterms with suppliers.

* Vet and select reliable freight forwarders.

* Analyze the true landed cost of your products for different shipping modes.

* Consolidate shipments from multiple suppliers to optimize container space.

* Manage the documentation and customs process to minimize the risk of delays.

Engaging an expert transforms logistics from a source of cost and confusion into a competitive advantage. If you’re looking to build a resilient and cost-effective supply chain, it’s essential to find the best sourcing agents in China who can act as your trusted partner on the ground. They can provide the local knowledge and industry expertise needed to make the smartest possible decisions for your business.

In today’s increasingly eco-conscious world, the cost of shipping is no longer measured in currency alone. The environmental cost, or carbon footprint, of logistics is a growing concern for consumers, regulators, and forward-thinking businesses. When viewed through this lens, the gap between sea and air freight becomes even more pronounced.

Maritime transport is, by a significant margin, the most carbon-efficient mode of transport for goods. While the shipping industry as a whole is a major emitter of greenhouse gases, the emissions per ton-kilometer (the metric for moving one ton of cargo over one kilometer) are dramatically lower than for aviation.

According to data from the European Environment Agency and other international bodies, the difference is staggering:

Sea Freight: Emits approximately 10-40 grams of CO2 per ton-kilometer.

Air Freight: Emits approximately 600-1,500 grams of CO2 per ton-kilometer.

This means that, on a like-for-like basis, shipping a product by air can generate 50 to 100 times more carbon emissions than shipping it by sea. This is a direct result of the physics discussed earlier: the immense energy required to keep a plane in the air translates into a massive consumption of fossil fuels and, consequently, a much larger carbon footprint.

This environmental disparity is no longer just a footnote in the logistics discussion. It is becoming a key factor in corporate strategy for several reasons:

Consumer Demand: A growing segment of consumers prefers to buy from brands that demonstrate a commitment to sustainability. A transparent and green supply chain can be a powerful marketing tool and a point of brand differentiation.

Regulatory Pressure: Governments and international bodies are implementing stricter environmental regulations on the logistics industry. This includes carbon taxes, emissions trading schemes, and efficiency standards. Businesses that rely heavily on high-emission transport like air freight may face increasing cost burdens in the future.

Corporate Social Responsibility (CSR): Many companies are integrating sustainability into their core values. Reducing the carbon footprint of their supply chain is a tangible way to meet CSR goals and build a more responsible and resilient business for the long term.

For importers, this adds another dimension to the freight decision matrix. While the urgency or value of a product may sometimes necessitate air freight, making a conscious effort to maximize the use of sea freight is the single most impactful step an importer can take to reduce the environmental impact of their operations. Choosing sea freight is not just a cost-saving measure; it is a vote for a more sustainable form of global trade.

The question, why is sea freight cheaper, opens the door to understanding the very mechanics of global trade. The answer, as we’ve seen, is rooted in the undeniable power of scale, the fundamental laws of physics that favor movement on water, and an operational model honed for maximum efficiency. Container ships are floating economies of scale, spreading immense costs over vast quantities of goods to achieve a per-unit price that air freight can never match.

However, to end the comparison there would be to miss the larger point. The choice between the ocean giant and the airborne sprinter is not a simple matter of cost versus speed. It is a critical strategic decision that strikes at the heart of your business’s financial health, operational agility, and even its environmental responsibility.

Choosing sea freight is a commitment to cost efficiency and sustainability, ideal for planned inventory and bulk goods. Choosing air freight is an investment in speed and flexibility, essential for high-value, time-sensitive, or perishable products. The truly savvy importer doesn’t exclusively use one or the other; they build a resilient supply chain by intelligently deploying both.

Navigating these complex waters—balancing landed costs, transit times, inventory pressures, and market demands—requires expertise. To ensure your logistics strategy becomes a source of competitive advantage, not a drain on resources, partnering with an experienced sourcing and logistics expert is invaluable. They can help you make the right choices, at the right time, for the right price.

Related Topics You may be Interested in: