In the intricate dance of international trade, precision in documentation is not merely a suggestion; it is the foundational rhythm that keeps the global supply chain moving smoothly. For entrepreneurs and businesses sourcing products from manufacturing hubs like China, navigating the complexities of shipping and customs can be a formidable challenge. Among the myriad of documents required, two stand out as both critical and commonly confused: the Proforma Invoice and the Commercial Invoice. While they may appear similar at first glance, understanding the profound difference between commercial and proforma invoice is essential for seamless transactions, timely customs clearance, and secure payment processes.

Confusing these two documents can lead to a cascade of costly problems, from shipments being held at customs and incurring expensive demurrage fees to payment disputes with suppliers and complications with financing. This guide serves as a comprehensive exploration of what is proforma invoice vs commercial invoice, delving into their distinct purposes, legal implications, and practical applications. We will dissect the anatomy of each document, clarify when and why each is used, and provide actionable insights for importers to leverage them effectively, particularly within the context of sourcing from Asia. Whether you’re arranging a shipment with a global carrier like FedEx or negotiating terms with a new supplier, a masterful understanding of the proforma vs commercial invoice dynamic is a non-negotiable asset in your international trade toolkit.

Before any goods are manufactured or funds are transferred, a clear agreement must be established between the buyer and the seller. This is where the proforma invoice enters the stage. It is the preliminary document that sets the terms, defines the products, and creates a shared understanding of the impending transaction.

A Proforma Invoice is, in essence, a preliminary bill of sale sent to buyers in advance of a shipment or delivery of goods. The Latin term “pro forma” translates to “for the sake of form” or “as a matter of form,” which perfectly encapsulates its primary function. It is a declaration from the seller to provide the specified goods at the specified prices and terms. However, a crucial distinction to make immediately is that a proforma invoice is not a true invoice in the financial sense. It is not a demand for payment and is not typically recorded in the financial accounts of the seller or buyer as an account receivable or payable.

Think of the proforma invoice as a highly detailed, formal quote. It goes beyond a simple price list by presenting the information in a standardized invoice format, making it suitable for a variety of preparatory and administrative purposes. It is a “good faith” agreement, outlining the seller’s commitment and providing the buyer with all the necessary information to move forward with the purchase. This document solidifies the details that have likely been discussed over emails or phone calls into a single, comprehensive statement, ensuring both parties are aligned before production begins or the final sales contract is executed.

The utility of a proforma invoice is multifaceted, serving critical functions for the importer, the exporter, and sometimes even customs authorities. Its issuance is a key milestone in the early stages of a trade deal.

For the Importer (Buyer): The buyer is often the party that requires the proforma invoice for several procedural reasons:

* Securing Financing or Letters of Credit (L/C): Financial institutions will not issue a letter of credit or approve a loan for an international purchase based on a simple email exchange. They require a formal document—the proforma invoice—that clearly details the goods, their value, and the terms of the sale. The proforma invoice acts as the supporting documentation for the financing application.

* Applying for Import Permits: Many countries require importers to obtain a license or permit to bring certain types of goods into the country. The government body responsible for issuing these permits will need the proforma invoice to understand the nature, quantity, and value of the prospective import.

* Internal Purchase Approval: In larger organizations, the procurement department needs a proforma invoice to submit a formal purchase requisition. The finance department uses it to allocate funds and approve the expenditure before a legally binding purchase order is issued.

* Budgeting and Cost Calculation: The detailed breakdown on a proforma invoice allows the importer to calculate the total landed cost of the goods accurately, including the product cost, shipping, insurance, and estimated customs duties.

For the Exporter (Seller/Supplier): From the seller’s perspective, issuing a proforma invoice is a professional way to formalize the sales process:

* Confirming the Order Details: It ensures that the buyer has officially agreed to the product specifications, pricing, and terms before the seller commits resources to production. This minimizes the risk of misunderstandings or disputes later on.

* Initiating the Transaction: It acts as a trigger for the buyer to open their letter of credit or arrange the initial deposit payment, signaling a firm commitment to the purchase.

* Facilitating Smooth Exports: In some countries, the exporter may need to present a proforma invoice to their own government to obtain an export license, particularly for controlled or strategic goods.

For Customs Clearance (In Specific Scenarios): While the commercial invoice is the primary document for customs, a proforma invoice can be used for shipments where there is no commercial transaction. For instance, when shipping with carriers like FedEx, a proforma invoice vs commercial invoice FedEx decision often arises. A proforma invoice is typically sufficient for:

* Shipping Samples: Sending product samples to a potential buyer.

* Sending Replacement Parts: Shipping warranty or replacement parts at no charge.

* Temporary Exports: Goods sent for repair, testing, or exhibition purposes that will be returned. In these cases, the proforma invoice declares the value of the goods for customs purposes, even though no sale has occurred.

To be effective, a proforma invoice must be detailed and accurate. A well-prepared document contains a wealth of information that is critical for all parties involved. Here is a breakdown of its essential components:

1. Seller/Exporter Details: Full legal name, address, phone number, and email of the selling company.

2. Buyer/Importer Details: Full legal name and address of the buying company. Accuracy here is vital for customs and financing.

3. Invoice Identifier: Clearly state “Proforma Invoice” to distinguish it from a commercial invoice. It should also have a unique reference number and the date of issue.

4. Detailed Description of Goods: This section cannot be vague. It should include model numbers, part numbers, detailed specifications, materials, and any other relevant identifiers. The more detail, the lower the risk of receiving the wrong product.

5. Quantity: The number of units for each item described.

6. Unit and Total Price: The price per unit and the extended total price for each line item.

7. Currency: The currency of the transaction (e.g., USD, EUR) must be clearly stated to avoid confusion.

8. Country of Origin: The country where the goods were manufactured. This is essential for customs to determine eligibility for trade agreements and to apply the correct duty rates.

9. HS Code: This is a standardized international system for classifying traded products. Providing the correct HS code on the proforma invoice helps the importer estimate duties and taxes in advance.

10. Incoterms: These are pre-defined commercial terms that define the responsibilities of sellers and buyers for the delivery of goods. The chosen Incoterm (e.g., FOB, EXW, CIF) dictates who pays for shipping, insurance, and at what point the risk transfers from seller to buyer. Understanding the nuances of these terms is critical. For instance, many importers weigh the pros and cons of different shipping arrangements; for a detailed comparison, you can explore our guide on FOB vs. EXW: Which Is Better for Importers in the UK?.

11. Payment Terms: The agreed-upon method and timing of payment (e.g., “30% T/T deposit, 70% balance against copy of Bill of Lading”). This is one of the most important negotiated elements of the deal.

12. Estimated Shipping Details: This includes the port of loading (e.g., Shanghai), port of discharge (e.g., Long Beach), expected mode of transport (Sea/Air), and an estimated shipping date.

13. Validity Period: A proforma invoice is not an open-ended offer. It should state a validity period (e.g., “This offer is valid for 30 days”), after which the prices and terms may be subject to change.

14. Exporter’s Signature: The document should be signed or stamped by an authorized representative of the exporting company.

Once the proforma invoice has served its purpose and the goods are ready to be shipped, the commercial invoice takes center stage. This is the official, final, and legally binding document that concludes the transaction and facilitates the physical movement of goods across international borders.

A Commercial Invoice is the primary document used in international trade that serves as a formal demand for payment from the seller to the buyer. It is a legally binding contract that confirms the sale and provides a complete record of the transaction. Unlike the proforma invoice, which is a forward-looking estimate, the commercial invoice is a backward-looking statement of fact, detailing exactly what has been shipped, its precise value, and the payment owed.

The primary audience for the commercial invoice is the customs authorities in both the exporting and importing countries. It is the single most important document they use to assess customs duties, taxes, and other fees. For this reason, the information on the commercial invoice must be 100% accurate and must perfectly match the details of the actual shipment. Any discrepancy, no matter how small, can trigger a customs inspection, leading to significant delays and potential fines. This is the crux of the difference between commercial and proforma invoice; one is a projection, while the other is a final, legally enforceable record.

The commercial invoice is a linchpin in the logistics and financial settlement of an international order. Its functions are critical and far-reaching.

Customs Clearance: This is its most vital role. Customs brokers in the destination country will submit the commercial invoice to the local customs agency. Officials use it to:

- Verify the Contents: Ensure the goods in the shipment match what is declared.

- Determine the Customs Value: Assess the dutiable value of the goods.

- Classify the Products: Use the HS code to apply the correct tariff rates.

- Check for Compliance: Ensure the goods comply with all import regulations.

Payment Settlement: The buyer uses the commercial invoice to authorize payment to the seller. If the payment method is a letter of credit, the bank will require the commercial invoice to match the L/C terms perfectly before releasing funds. For open account terms, the buyer’s accounting department uses it to process the payment.

Insurance Claims: In the unfortunate event that the cargo is lost or damaged during transit, the commercial invoice is the primary evidence used to establish the value of the goods for an insurance claim. Without an accurate commercial invoice, recovering the full value of the loss can be difficult.

Carrier Requirements: Global logistics providers such as FedEx, DHL, and UPS mandate a commercial invoice for all non-document international shipments. Their internal systems and brokerage teams rely on this document to prepare and submit customs entries on behalf of the shipper and recipient. The debate over commercial invoice vs proforma FedEx shipments is settled here: for any actual sale, only a commercial invoice will suffice for clearance.

Record Keeping: Both the importer and exporter use the commercial invoice as an official record of the transaction for their accounting, inventory management, and tax purposes.

The structure of a commercial invoice is similar to that of a proforma invoice, but with some key additions and a requirement for absolute finality. It must be a complete and accurate reflection of the shipment.

The essential elements include:

1. Clear Title: It must be explicitly titled “Commercial Invoice” or “Invoice.”

2. Seller/Exporter and Buyer/Importer Details: Same as the proforma, but must be the final, verified legal entities.

3. Invoice Number and Date: A unique, sequential invoice number from the seller’s accounting system and the final date of issue.

4. Reference Numbers: This is crucial. It must include the corresponding Purchase Order (PO) number from the buyer and may also reference the Proforma Invoice number to link the documents.

5. Shipping Details:

- Bill of Lading (B/L) or Airway Bill (AWB) Number: The unique tracking number for the shipment.

- Vessel Name/Flight Number: The specific ship or aircraft carrying the goods.

- Date of Export.

- Terms of Sale (Incoterms®): Confirmed final terms.

6. Full Product Description: As with the proforma, this must be detailed and precise.

7. HS Code, Quantity, Unit Price, Total Price: These must reflect the exact goods and values being shipped. There is no room for estimates here.

8. Total Invoice Amount: The final, total amount due in the specified currency.

9. Country of Origin: A mandatory declaration.

10. Packing Details: A summary of the shipment, including the number of packages, the type of packaging (cartons, pallets, etc.), and the total gross and net weight.

11. Seller’s Banking Information: Complete details for the buyer to make the payment (bank name, address, SWIFT code, account number).

12. Declaration and Signature: A signed declaration from the seller certifying that the information on the invoice is true and correct. This is a legally binding statement.

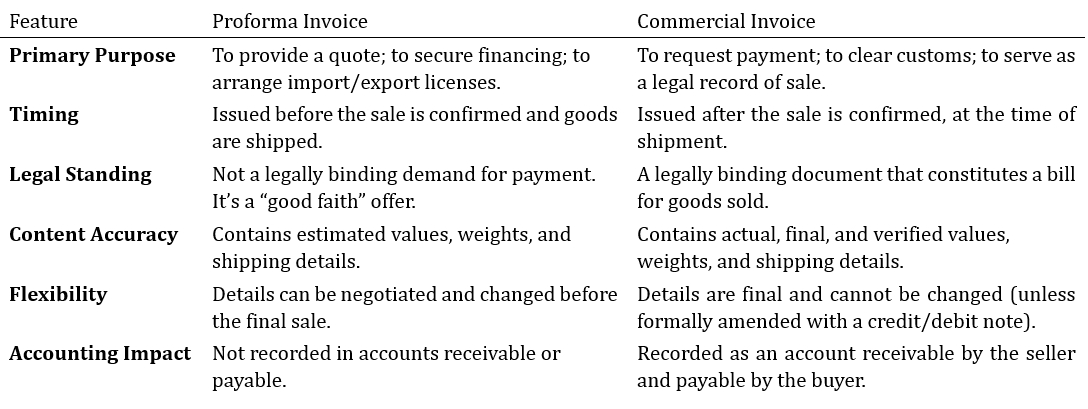

While they share a similar format, their differences in purpose, timing, and legal weight are what truly define the proforma vs commercial invoice relationship. Understanding these distinctions is fundamental to avoiding common import/export errors.

A simple way to visualize the differences is through a direct comparison:

The most critical takeaway is the shift from estimation to finality. The proforma invoice is part of the negotiation and planning phase. It’s a working document. The commercial invoice is part of the execution and settlement phase. It’s a final record.

The gray area between these two documents can be a minefield for inexperienced importers. Here are some common mistakes and their consequences:

Submitting a Proforma Invoice to Customs: Except for non-commercial shipments (like samples), submitting a proforma invoice for a regular import will result in its rejection by customs. This will halt the clearance process, and your shipment will be put on hold until a valid commercial invoice is provided. This is a common query related to shipping with carriers like FedEx, and the rule is clear: for a commercial shipment, a commercial invoice is mandatory.

Payment Disputes: A seller cannot legally force a buyer to pay based on a proforma invoice alone. The final payment obligation is tied to the commercial invoice and the fulfillment of the terms of sale (e.g., shipment of goods).

Discrepancies Between Documents: This is a major red flag for customs officials and banks. If the prices, quantities, or product descriptions on the commercial invoice do not match the proforma invoice, the purchase order, and especially a letter of credit, the shipment will be stopped for inspection, and the bank will refuse to make payment. Consistency across all trade documents (Packing List, Bill of Lading, Certificate of Origin, and Commercial Invoice) is paramount.

Under-Valuation: An importer might be tempted to ask a supplier to declare a lower value on the commercial invoice to pay less in customs duties. This is illegal, constitutes customs fraud, and can lead to severe penalties, including fines, seizure of goods, and being blacklisted from future importing activities.

Theory is important, but applying this knowledge to the real-world process of sourcing from China is where it becomes truly valuable. The proforma and commercial invoices serve as critical signposts at different stages of your sourcing journey.

Let’s walk through a typical import transaction to see how these documents function in practice.

Step 1: Finding Suppliers & Getting a Quote (Proforma Stage)

The journey begins with identifying potential partners. You might use online platforms, attend trade shows, or engage a sourcing agent. For those new to the landscape, learning how to find trusted wholesale suppliers on Alibaba can be a good starting point. After initial discussions about product specifications and volume, you will request a quote. A professional supplier will provide this in the form of a Proforma Invoice. This is your first opportunity to scrutinize the details. Does the product description match your requirements perfectly? Are the payment terms and Incoterms acceptable? The PI is your primary tool for negotiation at this stage.

Step 2: Placing the Order and Making the Deposit

Once you are satisfied with the proforma invoice, you will typically issue a formal Purchase Order (PO) that mirrors its details. This PO, along with the PI, forms the initial agreement. The supplier will then require a deposit (commonly 30%) to begin production. The proforma invoice provides the necessary details for you to process this first payment. A key part of this phase is effective negotiation. For insights into securing favorable conditions, consider the strategies outlined in how to negotiate with suppliers for better price and terms?.

Step 3: Production and Quality Control

While the goods are being manufactured, documentation takes a back seat to production oversight. However, this is the most critical time to ensure that the goods being made will match the description on the invoice. Implementing a robust quality control plan is non-negotiable. This should involve inspections at various stages of production. Engaging a professional service for inspection and quality control in manufacturing ensures an objective assessment of the products before they are packed and shipped. The final balance payment should never be made until you have a satisfactory final inspection report.

Step 4: Final Payment and Shipment (Commercial Invoice Stage)

When production is complete and the goods have passed the final inspection, the supplier will issue the Commercial Invoice. This is the bill for the final balance. Your task is to perform a final check, comparing the Commercial Invoice against your Purchase Order and the inspection report to ensure everything is correct. Once verified, you make the final payment. The supplier then releases the shipment to your freight forwarder, and the Commercial Invoice, along with the Bill of Lading and Packing List, becomes the core set of documents used to clear customs in China and in your home country.

For many businesses, managing this process from thousands of miles away is fraught with risk. This is where the expertise of a professional sourcing company becomes a significant asset. A dedicated agent can:

Vet Suppliers: Ensure that the suppliers you work with are experienced exporters who understand the importance of accurate documentation.

Review Documents: Scrutinize every proforma and commercial invoice for errors, inconsistencies, or unfavorable terms before you even see them. This simple step can prevent countless downstream problems.

Coordinate Logistics: Liaise between the supplier and the freight forwarder to ensure that all documentation is prepared correctly and submitted on time for a smooth departure and arrival.

Troubleshoot: If a documentation issue does arise with customs, an agent on the ground can communicate directly with the relevant parties in the local language and time zone to resolve it far more quickly than you could from overseas. By handling these critical details, a sourcing partner allows you to focus on your core business. You can learn more about how we streamline this entire process by exploring our sourcing services.

Consider the case of a small e-commerce business importing electronic gadgets from Shenzhen. They received their proforma invoice, which listed the HS code for “video game accessories.” They placed their order, and production went smoothly. However, when the supplier prepared the commercial invoice, their shipping clerk, unfamiliar with the specific product, used a more generic HS code for “consumer electronics.”

The shipment arrived at the port of Los Angeles. The customs broker submitted the commercial invoice, but the customs system flagged a discrepancy. The HS code on the invoice did not precisely match the product description, and it was different from what was used in previous, similar shipments from that supplier. This triggered a mandatory customs inspection. The shipment was moved to a Centralized Examination Station, where it sat for ten days waiting to be examined.

The consequences were severe:

* Demurrage and Detention Fees: The importer was charged daily fees by the port and the shipping line for the container’s extended stay, amounting to thousands of dollars.

* Inspection Costs: They had to pay for the labor and administrative costs of the customs inspection itself.

* Stock-Out: The delay caused them to miss their promotional sales window, leading to lost revenue and dissatisfied customers.

* Damaged Supplier Relationship: The incident created friction with their supplier, who was blamed for the error.

This entire costly episode could have been avoided with a simple, thorough review of the commercial invoice before the shipment left China—a standard procedure for any experienced importer or sourcing agent.

In the grand orchestra of global trade, the proforma invoice and the commercial invoice are two distinct but harmonizing instruments. The proforma invoice is the opening note—a carefully composed plan that aligns the buyer and seller. The commercial invoice is the powerful crescendo—the final, authoritative record that brings the transaction to its legal and financial conclusion.

Understanding what is proforma invoice vs commercial invoice is not about choosing one over the other; it’s about recognizing their unique and sequential roles. The proforma invoice builds the foundation for the deal, while the commercial invoice executes it and satisfies the stringent demands of customs authorities and financial institutions. For any business serious about sourcing products globally, mastering this documentation is not a peripheral task. It is a core competency, as critical as product design, quality control, or marketing. Giving these documents the meticulous attention they deserve will safeguard your investments, prevent costly delays, and pave the way for a resilient and profitable international supply chain. To begin your journey towards a more strategic and secure approach to sourcing, we encourage you to explore the wealth of resources available at Maple Sourcing.